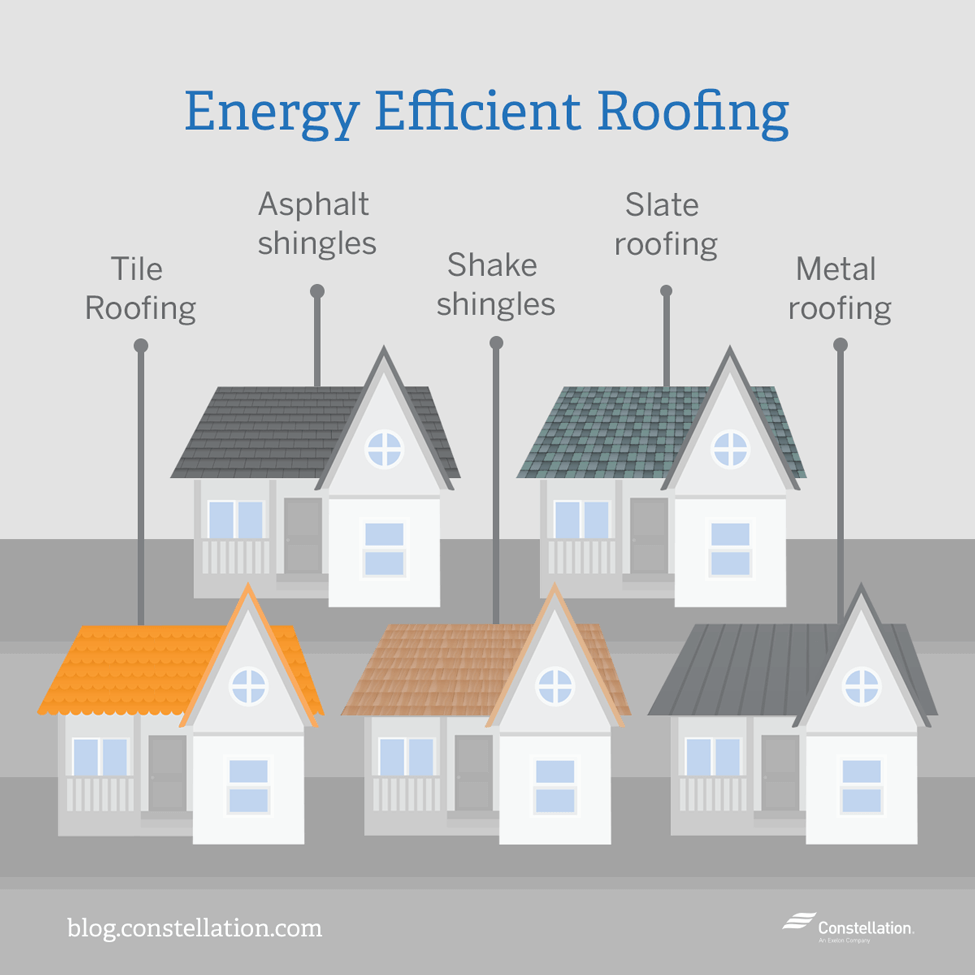

If you are replacing or adding a new roof to your home you could qualify for an energy efficient home improvement tax credit for as much as 10 percent of the cost not counting installation costs.

Government efficient roof tac credit 2017.

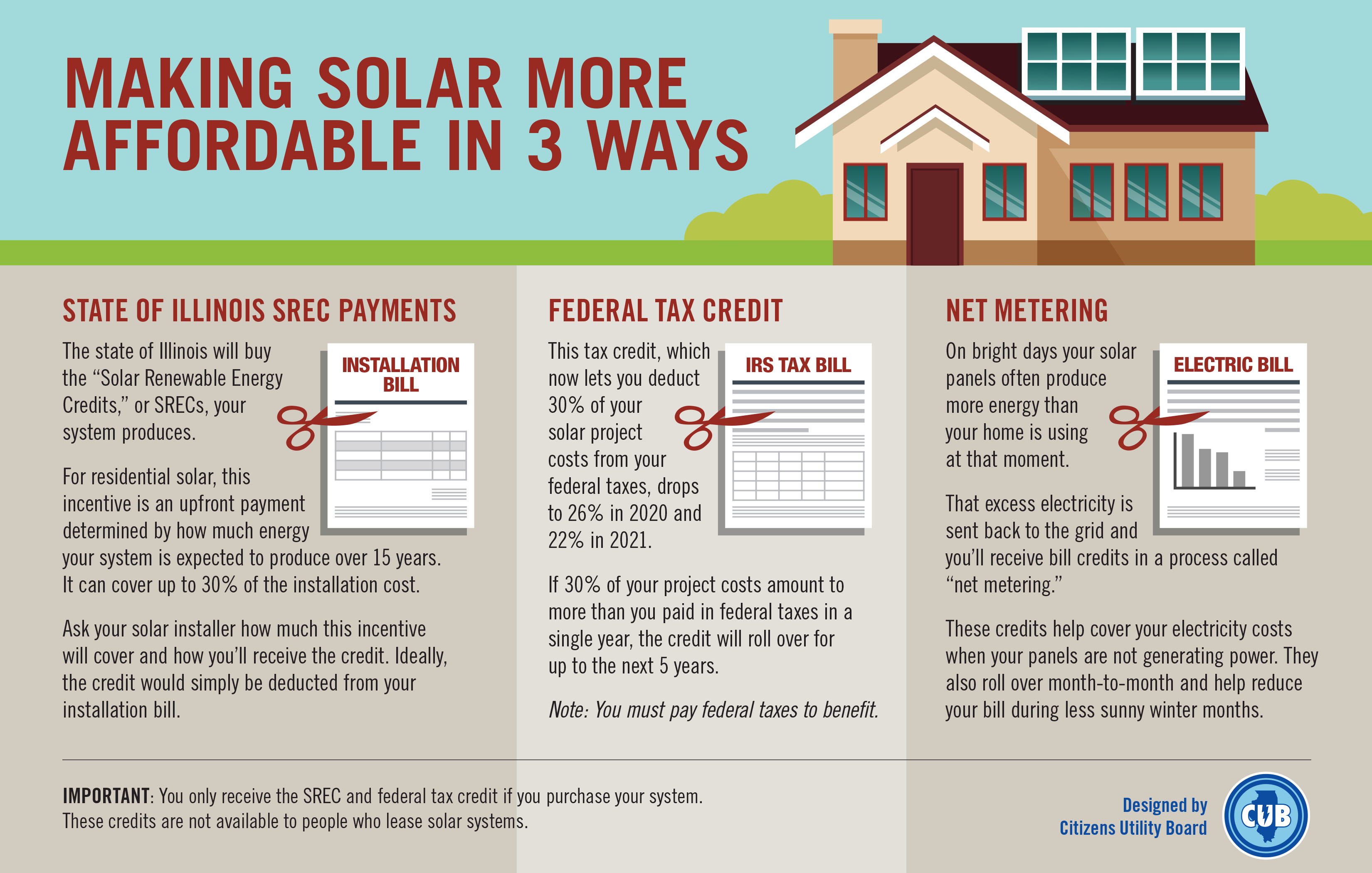

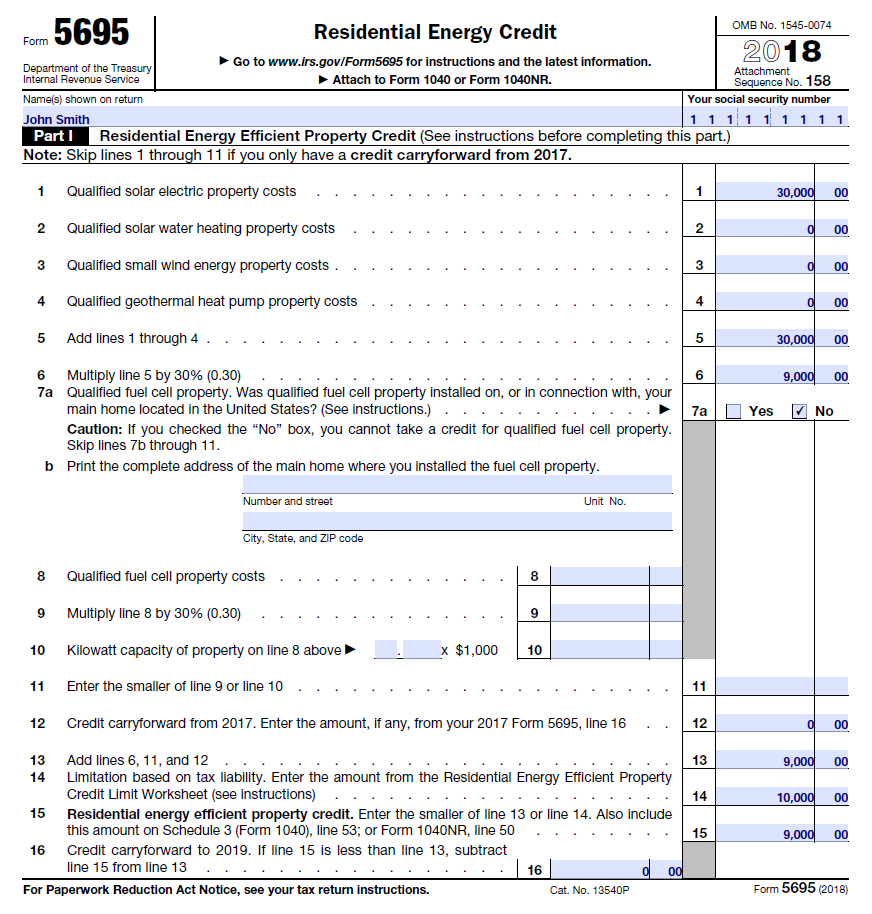

There is no upper limit on the amount of the credit for solar wind and geothermal equipment.

The energy efficient tax credit has a limit of 500 for all tax years after 2005.

The consolidated appropriations act 2018 extended the credit through december 2017.

Federal income tax credits and other incentives for energy efficiency.

Homeowners who have not submitted for the tax credit for any energy efficient home improvement new windows doors insulation or energy star qualified roof may qualify.

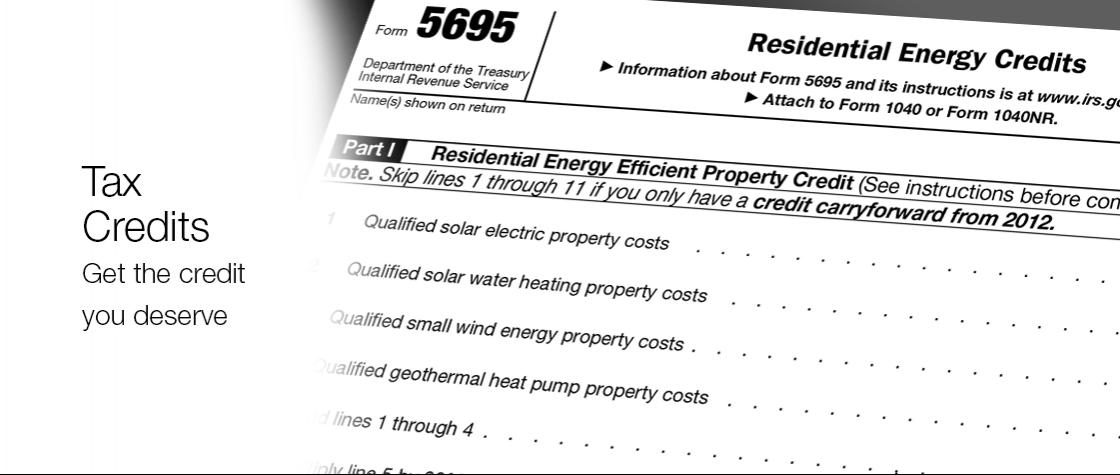

Non business energy property credit.

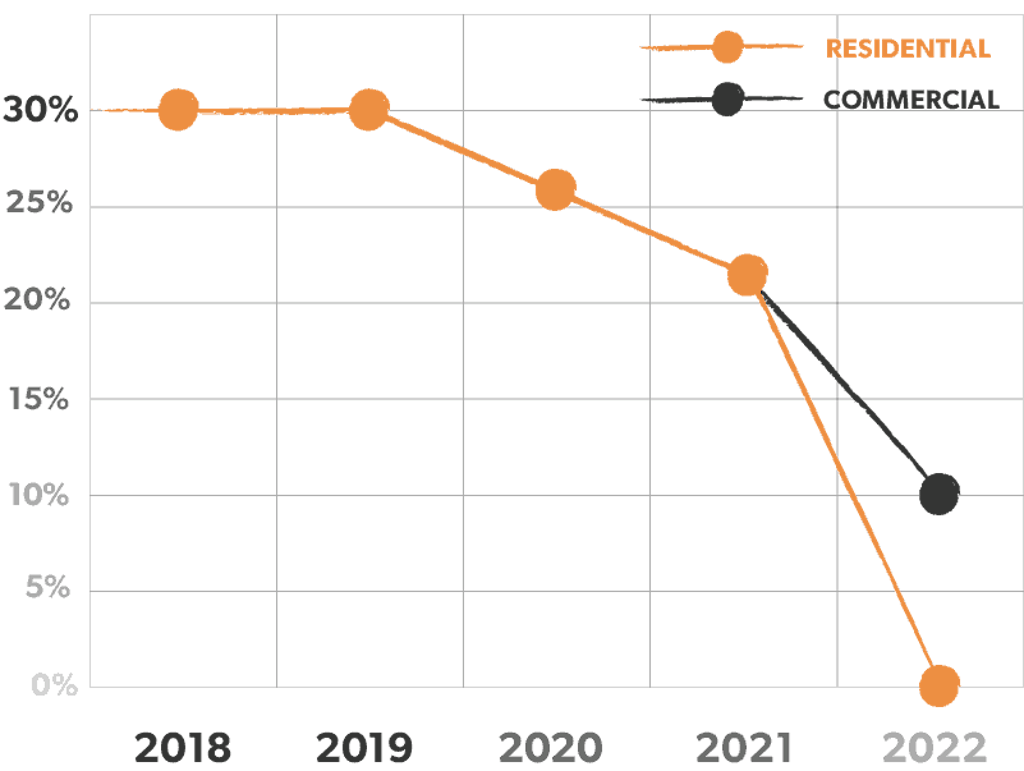

Here s what you need to know when filing for tax years 2019 2020 and 2021.

Homeowners who made energy efficient improvements to their home can qualify for a federal tax credit but you must meet certain rules.

The nonbusiness energy property credit expired on december 31 2017 but was retroactively extended for tax years 2018 and 2019 on december 20 2019 as part of the further consolidated appropriations act.

The maximum tax credit for fuel cells is 500 for each half kilowatt of power capacity or 1 000 for each kilowatt.

Taxpayers who made certain energy efficient improvements to their home last year may qualify for a tax credit this year.

Here s how to add your roof tax deduction to your tax return and the requirements to receive a roof tax credit.

The type of credit you may qualify for is listed in part ii for nonbusiness energy property which allows you to claim up to a 10 percent credit for certain energy saving property that you added to.

The credit had previously been extended by legislation.

Summary of tax credit under the bipartisan budget act of 2018 which was signed in february 2018 a number of tax credits for residential energy efficiency that had expired at the end of 2016 were renewed.

Tax credits for residential energy efficiency have now been extended retroactively through december 31 2020.

Part of the huge bipartisan budget act passed last month was an extension of tax credits for energy efficient upgrades to your home.

Irs tax tip 2017 21 february 28 2017.

That means if you made any qualifying home improvements in 2017.

The credit is equal to 30 of the cost including installation.

Here are some key facts to know about home energy tax credits.